Introduction

Smart investment tips can change the way you think about money, savings, and long-term security. Many people believe investing is only for the rich or highly educated, but that idea is far from the truth. With the right mindset and clear guidance, anyone can start investing wisely. The goal is not to get rich overnight but to grow wealth steadily and safely over time.

In today’s fast-changing financial world, keeping money idle is often riskier than investing it wisely. Inflation slowly reduces purchasing power, while smart investments help money grow. This is why learning smart investment tips early can make a huge difference in your future lifestyle and financial freedom. Even small, regular investments can turn into a strong financial foundation if managed properly.

This article is written for beginners and intermediate readers who want simple, practical advice. You do not need advanced financial knowledge to understand these concepts. Each section explains ideas in plain language, using examples where helpful. The focus is on building confidence, avoiding common mistakes, and making informed decisions.

By the end of this guide, you will understand what smart investing really means, why it matters, and how to apply proven strategies step by step. Whether your goal is saving for retirement, buying a home, or creating passive income, these smart investment tips will help you move forward with clarity and control.

What Is Smart Investment Tips?

Smart investment tips are practical guidelines that help individuals make better financial decisions when investing their money. These tips focus on reducing risks, improving returns, and aligning investments with personal goals. Instead of guessing or following trends blindly, smart investing relies on planning, patience, and knowledge.

At its core, smart investing means understanding where your money goes and why. It involves choosing investment options based on research rather than emotions. This could include stocks, bonds, mutual funds, real estate, or other assets. The key is not the asset itself but how and why you invest in it.

Smart investment tips also emphasize long-term thinking. Short-term market movements can be unpredictable, but long-term strategies often provide more stable results. Investors who follow smart principles usually review their plans regularly and adjust when needed.

In simple terms, smart investment tips help you invest with purpose, discipline, and confidence. They are not shortcuts or secret tricks. Instead, they are proven habits that successful investors follow consistently over time.

Why Is Smart Investment Tips Important?

Understanding smart investment tips is important because investing without knowledge can lead to unnecessary losses. Many people lose money not because investing is bad, but because they invest without a plan. Smart tips act as a guide that helps you avoid costly errors.

Another reason smart investment tips matter is financial independence. Investing wisely can create additional income streams and long-term security. Over time, returns from smart investments can support major life goals, such as education, travel, or retirement.

Smart investing also helps manage risk. Every investment carries some level of risk, but smart strategies help balance those risks. Diversification, proper timing, and realistic expectations all play a role in protecting your capital.

Finally, smart investment tips build confidence. When you understand what you are doing, you are less likely to panic during market changes. This calm approach often leads to better decisions and improved results over the long run.

Detailed Step-by-Step Guide

Step 1: Set Clear Financial Goals

Before investing, define your goals clearly. Are you saving for retirement, a house, or long-term wealth? Clear goals help determine the right investment approach.

Short-term goals usually require safer options. Long-term goals allow more flexibility and growth-focused investments. Write down your goals and timeframes to stay focused.

Step 2: Understand Your Risk Tolerance

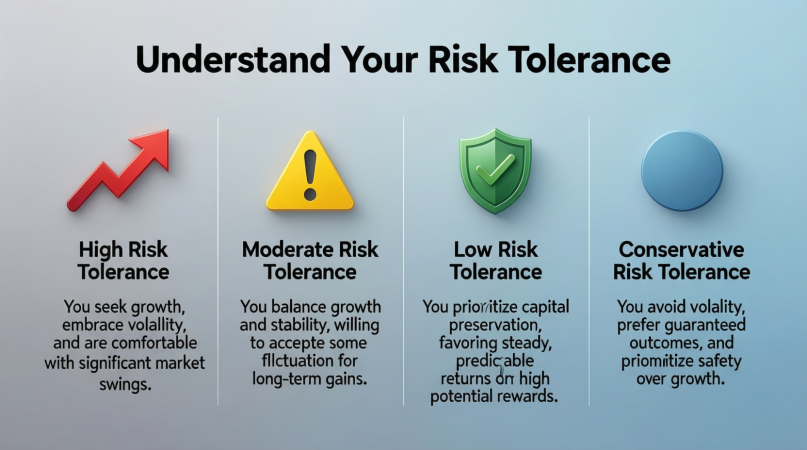

Risk tolerance is how much uncertainty you can handle. Some people are comfortable with market ups and downs, while others prefer stability.

Knowing your risk tolerance helps you choose suitable investments. It also prevents emotional decisions during market changes.

Step 3: Create a Budget for Investing

Only invest money you do not need for daily expenses. A clear budget ensures you invest consistently without financial stress.

Start small if needed. Regular contributions often matter more than large one-time investments.

Step 4: Diversify Your Investments

Diversification means spreading money across different assets. This reduces the impact of one poor-performing investment.

A diversified portfolio may include stocks, bonds, and other assets. Balance helps protect your overall investment value.

Step 5: Research Before Investing

Always research investment options carefully. Understand how they work and what factors affect returns.

Avoid investing based on rumors or hype. Reliable information leads to smarter decisions.

Step 6: Think Long Term

Markets move up and down, but long-term trends usually favor patient investors. Avoid frequent buying and selling.

Long-term investing reduces stress and often lowers costs.

Step 7: Monitor and Adjust Regularly

Review your investments periodically. Check if they still align with your goals and risk tolerance.

Adjust when necessary, but avoid reacting to every market change.

Benefits of Smart Investment Tips

- Helps grow wealth steadily over time

- Reduces financial stress and uncertainty

- Encourages disciplined saving habits

- Improves decision-making confidence

- Protects against inflation

- Supports long-term financial goals

Disadvantages / Risks

- Market fluctuations can cause short-term losses

- Requires patience and consistency

- Poor decisions can still lead to losses

- Overconfidence may increase risk

- Lack of knowledge can limit returns

Common Mistakes to Avoid

One common mistake is investing without a clear plan. Without goals, it is easy to make random choices. Another mistake is chasing quick profits, which often leads to losses.

Many investors also ignore diversification and put all money in one place. This increases risk unnecessarily. Emotional investing is another issue, especially during market highs or lows.

Finally, failing to review investments regularly can cause missed opportunities or growing risks.

FAQs

What is the best age to start investing?

The best age is as early as possible. Starting young allows more time for growth. However, it is never too late to begin investing smartly.

How much money do I need to start investing?

You can start with a small amount. Many investment options allow low initial investments. Consistency matters more than size.

Are smart investment tips suitable for beginners?

Yes, smart investment tips are designed to guide beginners. They focus on simple strategies and gradual learning.

How often should I review my investments?

Reviewing investments every six to twelve months is usually enough. Frequent checking can lead to unnecessary stress.

Is investing risky?

All investments carry risk. Smart investment tips help manage and reduce risk but cannot remove it completely.

Can I invest without professional help?

Yes, many people invest successfully on their own. However, learning and research are essential for good results.

Expert Tips & Bonus Points

Start early and stay consistent. Even small investments can grow significantly over time. Focus on learning continuously and improving your strategy.

Avoid comparing your progress with others. Everyone has different goals and timelines. Stick to your plan and remain patient.

Reinvest returns whenever possible. Compounding can significantly boost long-term growth. Lastly, keep emotions under control and trust your research.

Conclusion

Smart investment tips provide a clear path toward financial stability and long-term growth. They help investors move beyond fear and confusion by offering practical, proven guidance. Instead of relying on luck or trends, smart investing focuses on planning, discipline, and informed choices.

For beginners, these tips build a strong foundation. They explain how to start small, manage risks, and stay consistent. For intermediate investors, smart investment tips help refine strategies and avoid common mistakes. In both cases, the emphasis remains on long-term thinking rather than quick gains.

Investing is not about perfection. It is about progress and learning from experience. Markets will change, and challenges will appear, but a smart approach keeps you grounded. By setting clear goals, diversifying wisely, and reviewing your plans regularly, you stay in control of your financial future.

Ultimately, smart investment tips empower you to make confident decisions with your money. They turn investing into a habit rather than a gamble. With patience, knowledge, and consistency, you can build wealth steadily and create a more secure and comfortable life over time.