Introduction

Long term investment is one of the most reliable ways to build wealth slowly and safely over time. Instead of chasing quick profits, it focuses on patience, discipline, and smart planning. Many beginners feel confused or even scared when they hear the word “investment.” However, long term investing is not just for experts or wealthy people. Anyone with regular income and clear goals can start.

In simple terms, long term investment means putting your money into assets and allowing them to grow over several years. This approach reduces stress because you do not need to watch the market every day. Over time, the power of compounding works in your favor. Small, consistent investments can grow into a meaningful amount.

Another reason long term investment is popular is stability. Short-term trading often involves high risk and emotional decisions. On the other hand, a long-term mindset helps you stay calm during market ups and downs. You focus on progress, not daily noise.

This guide is designed for beginners and intermediate readers who want clarity. You will learn what long term investment means, why it matters, and how to start step by step. You will also discover benefits, risks, common mistakes, and expert tips. By the end, you will feel more confident and prepared to take control of your financial future with a smart long term investment strategy.

What is Long Term Investment?

Long term investment refers to investing money with the intention of holding assets for several years or even decades. The goal is steady growth rather than quick profits.

Usually, long term investment focuses on assets that increase in value over time. These include stocks, mutual funds, real estate, bonds, and retirement accounts.

Instead of reacting to short-term market changes, investors stay focused on long-term goals. This approach reduces emotional decisions and encourages consistent behavior.

For example, buying shares of a strong company and holding them for ten years is a long term investment. Over time, profits, dividends, and growth add up.

In simple words, long term investment is about patience, planning, and trust in the future.

Why is Long Term Investment Important?

Long term investment is important because it helps create financial security. It allows your money to grow while you focus on your life and career.

One key reason is compounding. When earnings generate more earnings, wealth grows faster. Time plays a big role here.

Another reason is risk reduction. Long-term investing smooths out market ups and downs. Short-term losses often recover with time.

Long term investment also supports life goals. Whether it is retirement, education, or buying property, long-term planning makes goals achievable.

Most importantly, it builds financial discipline. Regular investing encourages saving habits and smart money decisions.

Detailed Step-by-Step Guide

Step 1: Set Clear Financial Goals

Start by defining why you want to invest. Clear goals give direction and motivation.

Ask yourself what you want to achieve. Common goals include retirement, education, or wealth creation.

Also, set a timeline. Long term investment usually means five years or more.

When goals are clear, decisions become easier and more focused.

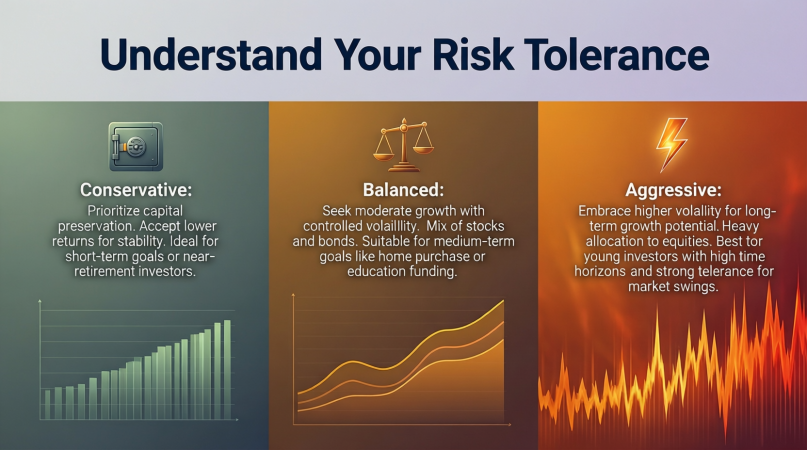

Step 2: Understand Your Risk Tolerance

Every investor has a different comfort level with risk. Knowing yours is essential.

Risk tolerance depends on age, income, responsibilities, and experience.

Younger investors often accept higher risk because they have more time.

Understanding risk helps you choose suitable investments and stay calm during market changes.

Step 3: Choose the Right Investment Options

There are many long term investment options available. Each has its own features.

Stocks offer higher growth potential but can be volatile.

Mutual funds provide diversification and professional management.

Bonds offer stability and predictable returns.

Real estate provides income and long-term appreciation.

Choose options that match your goals and risk level.

Step 4: Diversify Your Portfolio

Diversification means spreading money across different assets.

This reduces risk because losses in one area may be balanced by gains in another.

A diversified portfolio includes stocks, bonds, and other assets.

It protects your long term investment from sudden market shocks.

Step 5: Invest Regularly and Stay Consistent

Consistency is key in long term investment.

Investing regularly builds discipline and reduces timing risk.

Monthly or yearly contributions work well for most people.

Over time, small amounts grow into large sums through compounding.

Step 6: Monitor and Review Periodically

Long term investment does not mean ignoring your portfolio forever.

Review performance once or twice a year.

Make adjustments if goals or life situations change.

Avoid frequent changes based on short-term market movements.

Benefits of Long Term Investment

- Builds wealth steadily over time

- Takes advantage of compound growth

- Reduces stress from daily market fluctuations

- Encourages disciplined saving habits

- Supports major life goals

- Lower transaction costs

- Better tax efficiency in many cases

Disadvantages / Risks

- Requires patience and long commitment

- Market downturns can affect value temporarily

- Poor investment choices may underperform

- Inflation can reduce real returns

- Liquidity may be limited for some assets

Common Mistakes to Avoid

Many beginners make mistakes that harm long term investment success.

One common mistake is chasing quick profits. This often leads to losses.

Another error is lack of diversification. Putting all money in one asset increases risk.

Emotional decisions during market drops are also harmful. Panic selling locks in losses.

Ignoring fees and taxes can reduce returns over time.

Finally, starting too late limits the power of compounding.

Avoiding these mistakes improves long term investment outcomes.

FAQs

What is the ideal time horizon for long term investment?

Long term investment usually means five years or more. Many investors aim for ten, twenty, or even thirty years to maximize growth and reduce risk.

Is long term investment safe for beginners?

Yes, long term investment is suitable for beginners. It focuses on steady growth, diversification, and patience, making it less stressful than short-term trading.

How much money do I need to start?

You can start with small amounts. Many options allow monthly investments. The key is consistency, not the initial amount.

Can long term investment protect against inflation?

Yes, many long term investments grow faster than inflation. Stocks and real estate often help preserve purchasing power over time.

Should I invest during market downturns?

Market downturns can offer opportunities. Long term investors often benefit from buying at lower prices and holding for recovery.

How often should I review my investments?

Reviewing once or twice a year is enough. Frequent checking can lead to emotional decisions and unnecessary changes.

Expert Tips & Bonus Points

Start early to maximize compounding benefits.

Focus on quality assets with strong fundamentals.

Keep costs low by avoiding unnecessary fees.

Stay informed but avoid overreacting to news.

Maintain an emergency fund separate from investments.

Reinvest returns to accelerate growth.

Stick to your plan and trust the long term investment process.

Conclusion

Long term investment is not about getting rich quickly. It is about building wealth steadily through patience, planning, and discipline. By focusing on long term goals, investors reduce stress and improve financial stability. This approach works well for beginners because it encourages learning and consistency.

Throughout this guide, you learned what long term investment means and why it matters. You explored steps to start, benefits to enjoy, and risks to manage. You also discovered common mistakes and expert tips to stay on track.

The most important lesson is simple. Time is your biggest ally. Starting early, staying consistent, and remaining patient can make a huge difference. Even small investments can grow significantly over the years.

Long term investment is a journey, not a race. Markets will rise and fall, but a calm and focused mindset helps you succeed. With the right strategy and commitment, long term investment can support your dreams and secure your future. Take the first step today and let time work in your favor.