Introduction

Investing for beginners can feel confusing, stressful, and even risky at first. Many people believe investing is only for the rich or for financial experts who understand complex charts and numbers. In reality, investing is for anyone who wants to grow money over time and build a more secure future. With the right knowledge, clear goals, and simple strategies, anyone can start investing with confidence.

This guide to investing for beginners is written in simple English and focuses on practical steps you can actually follow. You do not need a finance degree or a large amount of money to begin. What you need is patience, consistency, and a basic understanding of how investing works. When done correctly, investing helps you beat inflation, grow savings, and achieve long-term financial goals such as buying a home, funding education, or enjoying a comfortable retirement.

Many beginners delay investing because they fear losing money. While risk is real, avoiding investing altogether can be even riskier in the long run. Money sitting idle often loses value over time. Learning how to invest wisely helps you manage risk instead of running away from it.

In this article, you will learn what investing really means, why it matters, and how to get started step by step. You will also discover common mistakes, risks, benefits, and expert tips designed especially for beginners and intermediate readers.

What Is Investing for Beginners?

Investing for beginners means putting money into assets with the goal of growing it over time. Instead of keeping all your money in cash, you use it to buy things that can increase in value or generate income. These assets may include stocks, bonds, mutual funds, real estate, or exchange traded funds.

For beginners, investing is about learning the basics and starting small. It is not about quick profits or risky bets. The main goal is long-term growth. When you invest, you allow your money to work for you while you focus on your daily life and career.

Investing usually involves risk, but risk can be managed through diversification, planning, and patience. Beginners should focus on understanding simple investment options before exploring advanced strategies. Over time, experience and knowledge help investors make better decisions and feel more confident.

Why Is Investing for Beginners Important?

Investing for beginners is important because it helps build financial security over time. Saving money alone is often not enough to keep up with rising costs. Investing gives your money a chance to grow faster than inflation.

Another reason investing matters is compound growth. When your investments earn returns, those returns can also generate earnings. Over many years, this effect can significantly increase wealth, even with small monthly investments.

Investing also helps you achieve life goals. Whether you want to start a business, buy property, or retire comfortably, investing provides a structured way to reach those goals. Starting early gives you more time to recover from market ups and downs.

Finally, investing builds financial discipline. It encourages regular saving, thoughtful decision making, and long-term planning. These habits can improve your overall financial health and reduce stress about money.

Step-by-Step Guide to Investing for Beginners

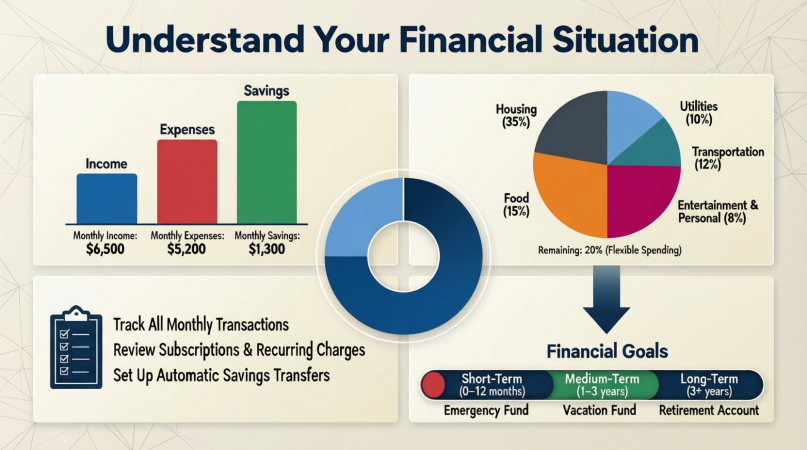

Step 1: Understand Your Financial Situation

Before investing, review your income, expenses, and savings. Make sure you have an emergency fund that covers at least three to six months of basic expenses. This prevents you from selling investments during emergencies.

List your debts and try to reduce high-interest ones. Investing works best when your finances are stable and organized.

Step 2: Set Clear Investment Goals

Define why you want to invest. Goals may include retirement, education, or buying a house. Each goal has a different time frame, which affects your investment choices.

Short-term goals usually require safer options, while long-term goals allow for more growth-focused investments.

Step 3: Learn Basic Investment Options

Beginners should understand common investment types:

- Stocks represent ownership in a company

- Bonds are loans to governments or companies

- Mutual funds pool money to invest in many assets

- Index funds track market performance

- Real estate involves property investments

Learning these basics helps you choose wisely.

Step 4: Choose a Beginner-Friendly Strategy

Simple strategies work best for beginners. Long-term investing, diversification, and regular contributions are proven approaches. Avoid frequent trading and emotional decisions.

Index funds and diversified mutual funds are popular choices for beginners due to simplicity and lower risk.

Step 5: Start Small and Stay Consistent

You do not need a large amount to start investing for beginners. Even small monthly investments can grow over time. Consistency matters more than timing the market.

Automating investments helps build discipline and reduces stress.

Step 6: Monitor and Adjust Over Time

Review your investments periodically. As your goals or income change, you may need to adjust your strategy. Avoid reacting to short-term market noise.

Patience and long-term focus are key to success.

Benefits of Investing for Beginners

- Helps grow money over time

- Protects against inflation

- Builds long-term wealth

- Encourages financial discipline

- Supports life and retirement goals

- Creates passive income opportunities

- Improves financial confidence

Disadvantages and Risks of Investing for Beginners

- Risk of losing money

- Market volatility can cause stress

- Requires patience and discipline

- Poor decisions can reduce returns

- Scams and misinformation exist

- Short-term losses are possible

Common Mistakes to Avoid

Many beginners make avoidable mistakes. One common error is chasing quick profits without understanding risks. Another mistake is investing without clear goals or planning.

Some beginners panic during market drops and sell too early. Others invest money they may need soon. Ignoring diversification and putting all money in one asset is also risky.

Learning from these mistakes helps protect your investments and improves long-term results.

FAQs About Investing for Beginners

What is the best investment for beginners?

The best investment for beginners depends on goals and risk tolerance. Many start with diversified index funds or mutual funds because they are simple and lower risk.

How much money do I need to start investing?

You can start investing with small amounts. Many platforms allow beginners to start with minimal funds and grow gradually.

Is investing risky for beginners?

All investing involves risk, but beginners can manage it through diversification, long-term planning, and avoiding emotional decisions.

How long should beginners invest for?

Investing works best over the long term. Beginners should aim for several years or decades, depending on goals.

Can beginners invest without financial knowledge?

Yes, beginners can invest by learning basic concepts and choosing simple strategies. Education improves confidence and results.

Should beginners invest during market downturns?

Market downturns can offer opportunities for long-term investors. Beginners should stay consistent and avoid panic selling.

Expert Tips and Bonus Points

Start investing as early as possible. Time is a powerful advantage. Focus on learning continuously and improving financial literacy.

Avoid comparing your progress with others. Everyone has different goals and timelines. Keep emotions under control and stick to your plan.

Reinvest earnings whenever possible. This accelerates compound growth and boosts long-term returns.

Finally, remember that investing for beginners is a journey. Progress matters more than perfection.

Conclusion

Investing for beginners is not about getting rich quickly. It is about building a strong financial foundation and making smart decisions over time. By understanding the basics, setting clear goals, and following simple strategies, anyone can start investing with confidence. The earlier you begin, the more time your money has to grow and recover from market changes.

This guide has shown that investing does not need to be complicated or intimidating. With patience, discipline, and continuous learning, beginners can reduce risks and increase potential rewards. Avoid common mistakes, stay consistent, and focus on long-term growth instead of short-term results.

Investing helps you take control of your financial future. It allows your money to work for you, rather than sitting idle. Whether your goal is security, freedom, or comfort, investing can help you get there step by step.

Start small, stay focused, and trust the process. With the right mindset and approach, investing for beginners can become one of the most powerful tools for achieving lasting financial success.