Introduction

In today’s fast-paced world, staying on top of your finances has never been more important. With markets fluctuating constantly, economic news emerging daily, and investment opportunities changing by the hour, having access to daily finance updates can make a huge difference in how you manage your money. Whether you are a beginner trying to build financial literacy or an intermediate investor looking to optimize your portfolio, daily financial news provides the insights you need to make informed decisions.

Daily finance updates are not just about knowing stock prices or interest rates—they help you understand broader trends, from inflation and economic policies to personal finance tips and investment strategies. By staying informed, you can anticipate market movements, plan your spending and savings more effectively, and identify profitable opportunities before they pass by.

For many people, financial news can feel overwhelming. However, with a simple, structured approach, even beginners can learn to interpret updates and use them to their advantage. In this article, we will explore what daily finance updates really are, why they matter, and how you can use them to grow your wealth, avoid risks, and stay financially healthy.

By the end of this guide, you will not only understand the importance of keeping up with daily financial news but also have a practical roadmap to integrate it into your everyday financial decisions.

Table of Contents

What is Daily Finance Updates?

Daily finance updates refer to regular information on financial markets, economic trends, and personal finance insights that are released each day. These updates can cover a wide range of topics, including:

- Stock market performance

- Currency exchange rates

- Interest rates and inflation data

- Corporate earnings announcements

- Government policy changes affecting the economy

- Personal finance tips like budgeting, saving, and investing

The goal of daily finance updates is to keep you informed so you can make smart money decisions in real time. They are typically available through financial news websites, newsletters, mobile apps, and social media platforms.

For beginners, daily finance updates provide a simple way to understand how money works and how economic events affect individual finances. For more experienced investors, these updates are a tool to identify trends, analyze risks, and adjust strategies quickly.

In essence, daily finance updates are like a roadmap for your financial journey—they help you see where the opportunities are, where the risks lie, and how to make the most of your resources.

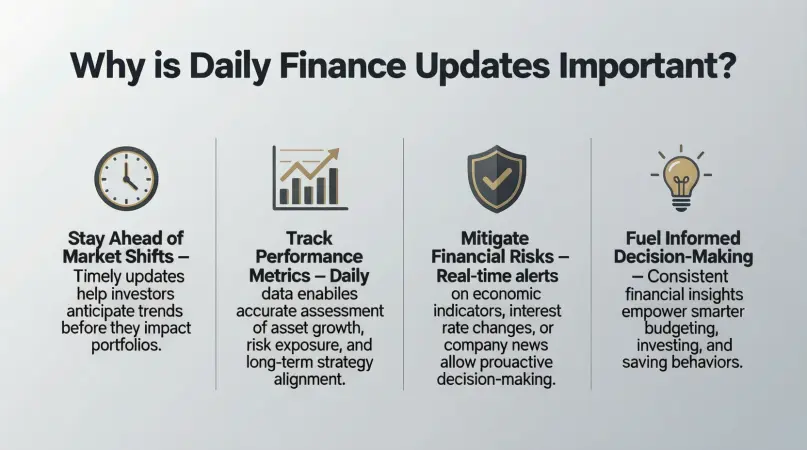

Why is Daily Finance Updates Important?

Keeping up with daily finance updates is crucial for several reasons:

- Informed Decision-Making: Financial news equips you with the information to make smart choices, whether it’s investing, saving, or spending.

- Market Awareness: Understanding daily market changes helps investors react promptly to opportunities or risks.

- Better Budgeting: Knowing economic trends, inflation, and interest rates allows you to plan your monthly budget more effectively.

- Wealth Growth: By following daily financial news, you can spot investment opportunities before they become mainstream.

- Risk Management: Timely updates help you avoid decisions that could lead to financial losses.

- Confidence Boost: Being informed about finances reduces stress and increases confidence in your money decisions.

Ultimately, staying up-to-date with daily finance news is a powerful habit that can positively impact your financial health and future.

Detailed Step-by-Step Guide to Using Daily Finance Updates

Step 1: Identify Reliable Sources

Before you start following financial news, it’s crucial to identify trustworthy sources. Some options include:

- Financial news websites (Bloomberg, Reuters, CNBC)

- Finance-focused mobile apps

- Newsletters from reputable financial experts

- Government economic reports

Make sure the sources provide accurate, timely, and unbiased information.

Step 2: Understand Different Types of Updates

Daily finance updates can be categorized into three main types:

- Market Updates: Stock prices, indices, and commodities trends

- Economic Updates: Interest rates, inflation, unemployment, and government policies

- Personal Finance Tips: Budgeting, saving, and investment strategies

By understanding the type of update, you can focus on information that is most relevant to your goals.

Step 3: Set a Daily Routine

Make checking daily finance updates a habit. Here’s a suggested routine:

- Spend 10–15 minutes in the morning reviewing market and economic news.

- Note significant events or trends affecting your investments or expenses.

- Check updates in the evening to see market closures, corporate news, and expert analyses.

Step 4: Track Key Metrics

To make the most of financial updates, track metrics relevant to your goals:

- Savings growth and spending patterns

- Stock portfolio performance

- Currency and commodity trends

- Economic indicators like inflation and interest rates

Keeping a simple spreadsheet or using a finance app can help organize and track these metrics.

Step 5: Analyze and Act

Receiving updates is only useful if you act on them. Ask yourself:

- Does this news impact my current financial plan?

- Should I adjust my investments or budget?

- Are there opportunities to save or invest more effectively?

Make decisions gradually and avoid impulsive reactions to minor fluctuations.

Step 6: Learn Continuously

Daily finance updates are also an educational tool. As you read, try to understand concepts like:

- Stock market trends

- Economic indicators

- Investment strategies

Over time, this knowledge will help you make more informed decisions with confidence.

Benefits of Daily Finance Updates

Keeping up with daily finance updates offers numerous advantages:

- Timely Awareness: Know important financial events as they happen

- Better Investment Decisions: Spot trends and opportunities early

- Improved Budgeting: Adjust spending based on economic conditions

- Risk Reduction: Avoid costly financial mistakes

- Financial Literacy: Learn about investments, markets, and economics

- Wealth Growth: Take advantage of opportunities to grow assets

- Confidence: Reduce anxiety by staying informed

Disadvantages / Risks of Daily Finance Updates

While daily financial news is beneficial, it has potential risks:

- Information Overload: Too much news can be overwhelming

- Short-Term Focus: Overreacting to daily fluctuations may harm long-term plans

- Misleading Sources: Not all updates are accurate or unbiased

- Emotional Decisions: Constant updates may trigger impulsive financial moves

- Time-Consuming: Following daily updates without focus can waste time

Awareness of these risks ensures you use updates wisely without being negatively impacted.

Common Mistakes to Avoid

To get the best out of daily finance updates, avoid these mistakes:

- Ignoring Reliable Sources: Always verify the credibility of information.

- Reacting Emotionally: Don’t make decisions based solely on market swings.

- Skipping Analysis: Simply reading updates without thinking won’t help.

- Overlooking Personal Goals: Not all financial news is relevant to your situation.

- Neglecting Long-Term Plans: Avoid focusing only on short-term news.

- Spreading Yourself Too Thin: Track only the metrics that matter to you.

By avoiding these errors, you can use daily finance updates effectively to grow and protect your wealth.

FAQs About Daily Finance Updates

1. How often should I check daily finance updates?

Ideally, check updates once in the morning and once in the evening. Avoid constant checking to prevent stress.

2. Can beginners benefit from daily finance updates?

Yes, beginners can learn how money and markets work while improving financial literacy. Start simple and focus on key metrics.

3. Which is better: news apps or websites?

Both are effective. Apps offer convenience and notifications, while websites often provide detailed analyses. Use a combination of both.

4. Are free finance updates reliable?

Many free sources are credible, but always cross-check with trusted sources to avoid misinformation.

5. How can daily finance updates improve investment decisions?

They help you identify trends, avoid risks, and spot opportunities for better returns.

6. Do I need to act on every update?

No. Focus only on updates relevant to your financial goals. Overreacting can lead to losses.

7. Can daily updates help with budgeting?

Absolutely. Updates on inflation, interest rates, and economic trends help you adjust spending and savings efficiently.

8. How do I avoid information overload?

Select a few trusted sources, track only relevant data, and create a daily routine for reviewing updates.

Expert Tips & Bonus Points

- Use Alerts: Set notifications for critical updates like stock movements or interest rate changes.

- Follow Experts: Track reliable financial analysts for insights.

- Combine with Personal Finance Tools: Use apps to track expenses and investments alongside updates.

- Learn Terminology: Understanding terms like “inflation,” “dividend,” and “market cap” enhances comprehension.

- Review Weekly Trends: A weekly summary complements daily updates and provides a broader perspective.

- Stay Calm: Financial markets fluctuate daily—avoid panicking over small changes.

Conclusion

Staying informed through daily finance updates is a cornerstone of financial success. Whether you are a beginner building your financial knowledge or an intermediate investor looking to optimize your portfolio, these updates provide timely, actionable insights. They help you make smarter investment decisions, budget effectively, manage risks, and grow your wealth over time.

By establishing a routine, selecting reliable sources, and analyzing updates thoughtfully, you can turn financial news into a powerful tool for personal and professional growth. Remember, it’s not just about knowing the numbers—it’s about understanding trends, making informed decisions, and staying one step ahead.

Incorporating daily finance updates into your life is a simple habit with long-term rewards. Start small, stay consistent, and watch your financial confidence and knowledge grow every day. By using the steps, tips, and strategies outlined in this guide, you are now equipped to make your money work smarter, not harder.