Introduction

Finding the best investment ideas can feel confusing, especially if you are just starting your financial journey. There are many options available, and each one promises growth, safety, or quick returns. However, smart investing is not about chasing trends or copying others. It is about understanding your goals, managing risk, and making informed decisions over time.

In today’s fast-changing world, investing has become more accessible than ever. You no longer need a large amount of money or expert-level knowledge to begin. With the right approach, even small and regular investments can grow into meaningful wealth. This is why learning about the best investment ideas is important for both beginners and intermediate investors.

This guide is designed to explain investment concepts in simple English. It focuses on clarity, practicality, and long-term thinking. Instead of complex theories, you will find easy explanations, real-life examples, and step-by-step guidance. The aim is to help you build confidence and avoid common mistakes.

Moreover, investing is not only about making money. It is also about protecting your savings from inflation, planning for the future, and achieving financial freedom. Whether your goal is buying a home, funding education, or building retirement security, the right investments can support your plans.

By the end of this article, you will have a clear understanding of how investments work, why they matter, and how to choose options that match your needs. Most importantly, you will learn how to think like a smart investor and take steady steps toward long-term success.

What is Best Investment Ideas?

Best investment ideas refer to smart and practical ways to put your money to work so it can grow over time. These ideas focus on balancing risk and reward while matching your financial goals. Instead of random choices, good investment ideas are based on research, planning, and patience.

In simple terms, investing means using your money to buy assets that have the potential to increase in value. These assets may also generate regular income. The best investment ideas are those that suit your budget, time horizon, and comfort with risk.

For beginners, the best investment ideas are usually simple and easy to understand. They avoid unnecessary complexity and focus on steady growth. Intermediate investors, on the other hand, may look for diversification and higher returns while still managing risk carefully.

Importantly, a good investment idea is not the same for everyone. What works for one person may not work for another. This is why understanding yourself is just as important as understanding the investment itself.

Why is Best Investment Ideas Important?

Choosing the best investment ideas is important because it directly affects your financial future. Poor choices can lead to losses, stress, and missed opportunities. On the other hand, smart choices can help you build wealth steadily and confidently.

One key reason investing matters is inflation. Over time, the value of money decreases. If your savings sit idle, they lose purchasing power. Investments help your money grow faster than inflation, protecting your lifestyle.

Another reason is financial independence. Relying only on income from work can be risky. Investments create additional income streams, giving you more control and flexibility. This is especially useful during emergencies or retirement.

The best investment ideas also encourage discipline. Regular investing builds healthy financial habits. It teaches patience, planning, and long-term thinking, which are essential skills for financial success.

Finally, investing supports life goals. Whether you want to start a business, travel, or support your family, smart investments make these goals achievable. This makes choosing the right ideas a crucial step in your financial journey.

Detailed Step-by-Step Guide

Step 1: Understand Your Financial Goals

Start by defining your goals clearly. Ask yourself why you want to invest and what you want to achieve.

Short-term goals may include saving for a vacation or emergency fund. Long-term goals often include retirement or buying property. Clear goals help you choose suitable investment options.

Step 2: Know Your Risk Tolerance

Risk tolerance refers to how much uncertainty you can handle. Some investments fluctuate more than others.

If market ups and downs make you uncomfortable, choose safer options. If you can accept short-term losses for higher long-term gains, moderate risk may suit you.

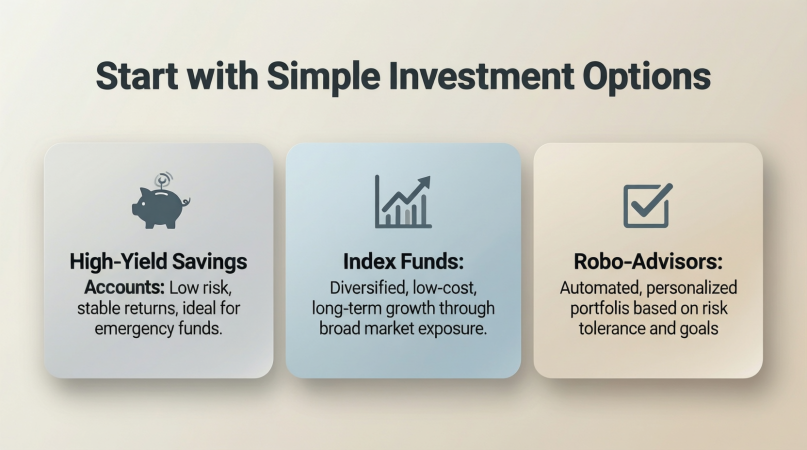

Step 3: Start with Simple Investment Options

Beginners should focus on easy and proven choices. These include diversified funds, savings-based products, or stable income options.

Simple investments reduce confusion and help you learn without unnecessary stress.

Step 4: Diversify Your Investments

Diversification means spreading money across different assets. This reduces risk and improves stability.

Avoid putting all your money into one option. Instead, combine low-risk and moderate-risk investments for balance.

Step 5: Invest Regularly and Stay Consistent

Consistency is key to success. Regular investing builds wealth gradually and reduces timing risk.

Even small amounts invested consistently can grow significantly over time through compounding.

Step 6: Monitor and Adjust Periodically

Review your investments regularly. Check performance and ensure alignment with your goals.

Make adjustments when needed, but avoid frequent changes based on emotions or short-term trends.

Benefits of Best Investment Ideas

- Helps grow wealth steadily over time

- Protects savings from inflation

- Builds multiple income sources

- Encourages financial discipline

- Supports long-term life goals

- Reduces financial stress and uncertainty

Disadvantages / Risks

- Market fluctuations can cause short-term losses

- Poor choices may lead to capital loss

- Requires patience and long-term commitment

- Emotional decisions can harm returns

- Some investments lack liquidity

Common Mistakes to Avoid

Many investors make avoidable mistakes that affect results. One common error is investing without a clear plan. Without goals, decisions become random and risky.

Another mistake is chasing quick profits. High returns often come with high risk. Beginners should avoid schemes that promise guaranteed profits.

Lack of diversification is also risky. Putting all money into one investment increases exposure to losses. Spreading investments is safer.

Emotional investing is another issue. Fear and greed lead to poor timing. Staying calm and focused on long-term goals is essential.

Finally, ignoring regular reviews can hurt performance. Markets change, and so do personal goals. Periodic evaluation keeps your strategy relevant.

FAQs

What are the best investment ideas for beginners?

The best investment ideas for beginners are simple, low-cost, and diversified options. These help reduce risk while offering steady growth.

How much money do I need to start investing?

You can start investing with a small amount. Consistency matters more than size. Regular small investments can grow significantly.

Are investments risky for beginners?

All investments carry some risk. However, choosing simple and diversified options helps manage risk effectively.

How long should I stay invested?

Investing works best over the long term. Staying invested allows compounding to work and reduces the impact of short-term volatility.

Can I invest while earning a regular income?

Yes, investing alongside regular income is ideal. It allows steady contributions without financial pressure.

How do I know if an investment is right for me?

An investment is right if it matches your goals, risk tolerance, and time horizon. Understanding these factors is key.

Expert Tips & Bonus Points

Start early to benefit from compounding. Time in the market is more important than timing the market.

Keep learning continuously. Financial knowledge improves decision-making and confidence.

Automate investments where possible. Automation removes emotional bias and ensures consistency.

Maintain an emergency fund before investing heavily. This prevents forced withdrawals during crises.

Stay patient and disciplined. Successful investing rewards those who remain committed over time.

Conclusion

Choosing the best investment ideas is one of the most important financial decisions you will ever make. It shapes your future, protects your savings, and supports your long-term goals. While investing may seem complex at first, the basics are simple when explained clearly and applied consistently.

The key is to start with a clear plan. Understand your goals, assess your risk tolerance, and choose investments that align with your needs. Avoid rushing into decisions or following trends without understanding them. Instead, focus on steady progress and long-term thinking.

Remember that investing is a journey, not a one-time action. Markets will rise and fall, but patience and discipline help you stay on track. Regular reviews and small adjustments ensure your strategy remains effective as your life changes.

Most importantly, believe in the process. Even modest investments can grow into meaningful wealth when given enough time. By applying the principles shared in this guide, you can approach investing with confidence and clarity.

With the right mindset and knowledge, anyone can benefit from smart investing. Start today, stay consistent, and let your money work for you over the years to come.