Introduction

Investing in the stock market is no longer a complex task reserved for financial experts. Today, anyone with an internet connection can buy stock online with ease and confidence. The process has become user-friendly, affordable, and accessible, making it one of the best ways to grow your wealth over time. Whether you are a beginner trying to make your first investment or an intermediate investor looking to expand your portfolio, understanding how to buy stock online is essential.

The digital age has transformed stock trading. Gone are the days of calling brokers and waiting for hours to place an order. Now, with just a few clicks, you can buy shares of your favorite companies from the comfort of your home. This convenience, however, comes with the responsibility of making informed decisions. Knowledge about stocks, market trends, and risk management is crucial to avoid losses and maximize returns.

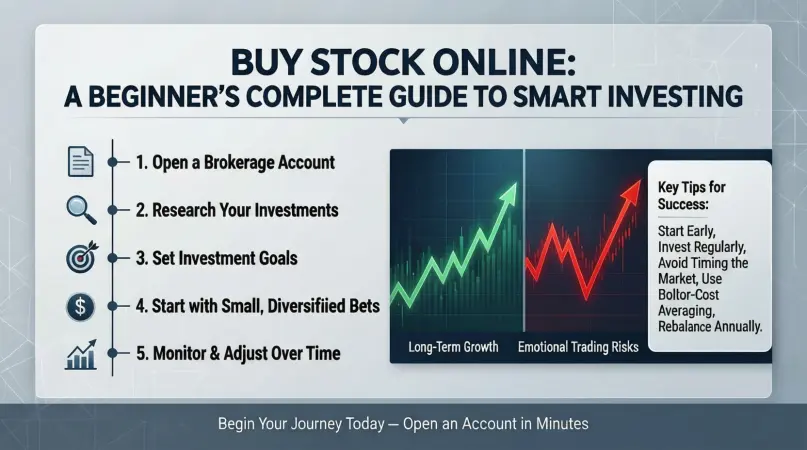

This guide will cover everything you need to know about buying stock online, including what it is, why it matters, step-by-step instructions, the benefits and risks, common mistakes, and expert tips to help you succeed. By the end, you’ll feel confident navigating the online stock market and making investments that align with your financial goals.

Table of Contents

What is Buy Stock Online?

Buying stock online refers to the process of purchasing shares of a company using an internet-based trading platform or brokerage account. Instead of physically visiting a stock exchange or relying on a broker, investors can trade stocks digitally through apps or websites provided by brokers.

Stocks represent ownership in a company. When you buy stock online, you are essentially buying a small piece of that company. This ownership entitles you to a portion of the company’s profits, which may be paid as dividends, and potential growth in the stock’s value over time.

Online stock trading is made possible by stockbroker platforms that connect investors to stock exchanges. These platforms provide real-time data, charts, news, and tools to analyze stock performance. Popular platforms often offer low fees, mobile-friendly interfaces, and educational resources to help both beginners and seasoned traders make informed decisions.

In essence, buying stock online simplifies the investing process, reduces costs, and opens opportunities for anyone interested in building wealth through the stock market.

Why is Buy Stock Online Important?

Investing in stocks is one of the most effective ways to grow wealth over time. Understanding the importance of buying stock online can help you make better financial decisions:

- Accessibility: Anyone can start investing with a few dollars, removing the barrier of traditional investing.

- Convenience: Buy and sell stocks anytime from anywhere using your computer or smartphone.

- Growth Potential: Stocks historically provide higher long-term returns compared to other investment options like savings accounts or bonds.

- Diversification: Online platforms allow you to invest in multiple sectors and companies, reducing risk.

- Financial Independence: Consistent investing can help you achieve long-term financial goals, such as retirement or funding education.

With online tools and easy access, buying stocks is no longer intimidating. It has become a fundamental step toward financial literacy and independence for many individuals.

Detailed Step-by-Step Guide to Buy Stock Online

Buying stock online is straightforward when you follow a structured process. Here’s a detailed step-by-step guide:

Step 1: Choose a Reliable Online Broker

Selecting the right broker is critical. Look for:

- Low fees or commission-free trading

- User-friendly platform

- Access to research and analysis tools

- Good customer support

- Regulatory compliance

Examples of popular brokers include E*TRADE, Robinhood, Fidelity, and TD Ameritrade.

Step 2: Open a Trading Account

- Fill in your personal information (name, address, date of birth)

- Provide identification documents (passport, driver’s license)

- Link your bank account for deposits and withdrawals

Most brokers offer instant verification, so you can start trading quickly.

Step 3: Fund Your Account

- Deposit money from your bank account

- Some brokers allow credit/debit card funding

- Decide how much you want to invest initially

Start small if you are a beginner to reduce risk while learning.

Step 4: Research Stocks

Before buying, research the companies you’re interested in:

- Review financial statements

- Analyze stock charts and trends

- Check company news and performance

- Compare industry competitors

Use broker-provided research tools or financial news websites.

Step 5: Decide How Many Shares to Buy

- Consider your budget and risk tolerance

- Start with a smaller number of shares if you’re new

- Remember, diversification is key to managing risk

Step 6: Place a Buy Order

There are different types of orders:

- Market Order: Buys at the current market price (fast and simple)

- Limit Order: Buys at a specified price or lower (gives price control)

- Stop Order: Buys once the stock reaches a certain price (used for strategy)

Step 7: Monitor Your Investments

- Track stock performance regularly

- Review your portfolio monthly

- Make adjustments if needed based on market trends or personal goals

Step 8: Sell Stocks Strategically

- Sell when your target profit is reached

- Consider market conditions

- Avoid panic selling during short-term fluctuations

By following these steps, you can confidently navigate the online stock market.

Benefits of Buying Stock Online

Buying stocks online offers several advantages:

- Lower Costs: Online brokers usually charge minimal fees compared to traditional brokers.

- Convenience: Trade anytime from home or on the go.

- Educational Tools: Many brokers offer tutorials, news, and analysis for informed decisions.

- Diversification: Easily invest in multiple companies and industries.

- Real-Time Trading: Immediate access to market prices allows timely decisions.

- Ownership and Dividends: Participate in company growth and earn dividends.

Disadvantages / Risks

While there are many benefits, online stock trading carries risks:

- Market Volatility: Stock prices can fluctuate rapidly.

- Emotional Decisions: Impulsive buying or selling can lead to losses.

- Technical Issues: Platform downtime or internet issues may delay trades.

- Lack of Knowledge: Beginners may make mistakes without proper research.

- Scams: Unregulated brokers or shady apps can pose risks.

Common Mistakes to Avoid

Avoid these pitfalls to succeed in online stock trading:

- Investing Without Research: Never buy stock based solely on rumors or tips.

- Ignoring Risk Management: Always diversify and set limits.

- Overtrading: Excessive buying and selling can eat profits.

- Chasing Losses: Avoid trying to recover losses quickly; it often backfires.

- Neglecting Fees: Watch out for hidden charges that reduce returns.

- Failing to Monitor Portfolio: Regular review is essential for long-term success.

FAQs

1. How much money do I need to buy stock online?

You can start with as little as $50 or $100 on most platforms. Some brokers allow fractional shares, so you can invest even smaller amounts.

2. Can beginners really profit from buying stocks online?

Yes, beginners can profit, but success requires patience, research, and a long-term approach. Avoid expecting instant wealth.

3. Are online stock trading platforms safe?

Yes, if you use regulated brokers with proper security measures. Always check reviews and ensure the platform is registered with financial authorities.

4. How do I choose which stock to buy?

Focus on company fundamentals, growth potential, and industry trends. Diversify your investments to spread risk.

5. What is the difference between a market and limit order?

- Market Order: Buys immediately at current price.

- Limit Order: Buys only at your specified price or lower.

6. Can I sell my stock anytime?

Yes, you can sell anytime during market hours. However, selling too frequently may result in losses or higher fees.

7. What are dividends, and do I get them when I buy stock online?

Dividends are a portion of company profits paid to shareholders. If your stock pays dividends, owning shares online automatically qualifies you for them.

8. Is it better to invest in individual stocks or ETFs?

ETFs offer diversification and lower risk, while individual stocks can provide higher returns but are riskier. Consider your goals and risk tolerance.

Expert Tips & Bonus Points

- Start Small: Begin with a small investment to learn the process without significant risk.

- Diversify: Spread investments across sectors to reduce potential losses.

- Use Stop-Loss Orders: Limit potential losses automatically.

- Keep Learning: Follow financial news, blogs, and stock analysis regularly.

- Avoid Emotional Trading: Stick to your strategy, don’t panic over market swings.

- Reinvest Profits: Use dividends and profits to buy more stocks for compounding growth.

- Track Performance: Maintain a portfolio tracker to monitor returns and make informed decisions.

- Consider Long-Term Goals: Think beyond short-term gains; long-term investments often yield better results.

Conclusion

Buying stock online has revolutionized investing, making it accessible, convenient, and affordable for everyone. Whether you are a beginner just starting or an intermediate investor aiming to diversify, understanding the process, risks, and strategies is essential. By choosing a reliable broker, conducting thorough research, and following a structured approach, you can confidently buy stock online and grow your wealth over time.

While there are risks, careful planning, diversification, and education can minimize them. Avoid common mistakes such as overtrading or chasing losses, and use the expert tips provided to maximize your potential.

The key to successful online investing is patience, consistency, and informed decision-making. By following this guide, you are taking the first step toward financial independence and a future where your money works for you. Start small, stay disciplined, and watch how buying stock online can transform your financial journey.